President Bola Tinubu is considering a six-month suspension of the collection of taxes, levies, and charges for several sectors of the economy. This measure is intended to combat inflation and stabilize food prices across Nigeria.

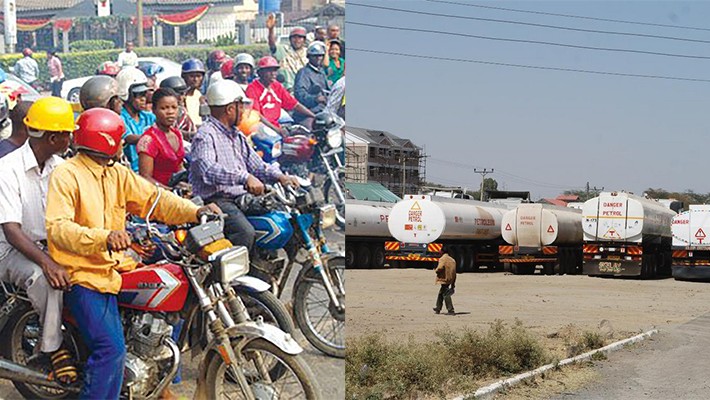

The targeted recepients for this tax suspension include Okada riders, goods transporters, fuel transporters, wheelbarrow and cart pushers, shop owners, and market traders. The draft executive order titled “Inflation Reduction and Price Stability (Fiscal Policy Measures, etc.) Order 2024,” dated May 1, specifies these actions.

President Tinubu cited his authority under section 5 of the Nigerian Constitution (as amended) and section 38 of the Value Added Tax Act, Cap V1 2004 (as amended), to propose these fiscal policy measures.

The suspension, the draft order revealed, is for “road haulage tax and any other levy or charges on transportation of goods; bicycle, truck, canoe, wheelbarrow and cart fees.”

Others include: “business premises registration; shops, kiosks, and market taxes and levies; animal trade and produce sales tax; further suspension of VAT and diesel (AGO).”

The draft order also directed that “States and Local Governments shall take appropriate steps to support the implementation of the tax suspension.”