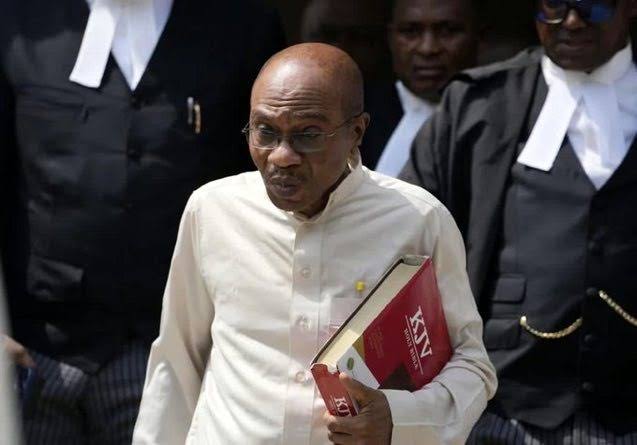

The trial of the former Governor of the Central Bank, Godwin Emefiele, continued Wednesday at the Lagos High Court, Ikeja with the testimony of the business relationship manager with Zenith Bank plc, Ifeoma Ogbonnaya.

Picking up from where she left off on Tuesday, the witness told the court that there was no relationship between Godwin Emefiele and the companies.

While being cross-examined by Emefiele’s Counsel, Olalekan Ojo, SAN, the witness said neither the former governor nor his wife were signatories to the three accounts of the private companies, namely: Limelight Multidimensional Services Ltd, Comec Support services Ltd and Andswin Resources Ltd.

She also reiterated that the transactions involving the companies would not be processed until it was approved by Mrs Emefiele.

The witness said: “l still maintain that Mrs Margaret Emefiele gave me instructions through phone calls, whatsApp chat and my official email.”

“I saved Mrs Emefiele’s number as ‘Margo’ on my phone and she has several numbers but I can only remember her foreign number which is +447941835451.”

“The phone numbers are saved on my mobile device, IPhone 11 which are for my contacts, both personal and official.”

The witness further told the court that instructions to banks are not oral but in writing and before she came to court to give evidence, she had opportunity to review the account opening of the three companies.

Ogbonnaya maintained that Emefiele’s name and his wife’s did not appear as shareholders or signatories to the corporate accounts of the companies.

She stated that the shareholders of Limelight Multidimensional Ltd were Mr Stephen Ogwa, Patricia Essan, Bruce Olotu Agustina Omoile, Oriekose Agustina and Ibrahim Oluwadamilare.

She said that Bruce Olotu had the highest share of 600,000 in Limelight multidimensional Ltd.

According to her: “I did not come across any document in the account opening package that Mrs Emefiele is a direct beneficial owner of the corporate accounts of the companies.”

“There is a regulatory requirements on the collection of information on beneficial owners of a corporate account.”

“There is a Know Your Customer (KYC) platform through which banks collect information on the beneficial owner of an account but I was not involved at the initial opening of the account.”

“When the former relationship officer left, I continued the relationship based on what the previous relationship officer has been managing them with.”

The witness also said KYC was before the court and that financing risk assessment formed part of KYC.

She also confirmed to the court that in the running of the business of banking, Zenith Banks followed guidelines as regards deposit and withdrawal funds.