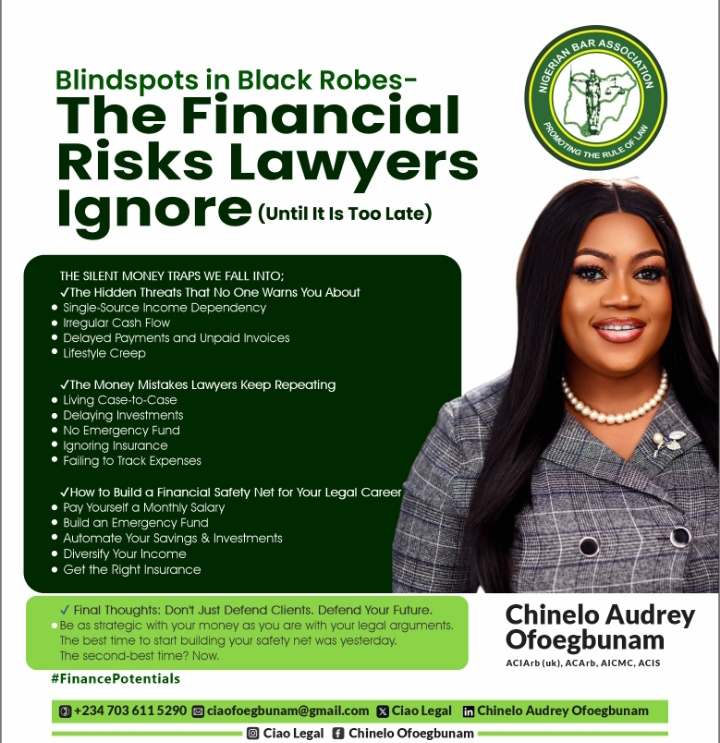

By Chinelo Audrey Ofoegbunam, Esq, ACIARb (UK), ACArb, AICMC, ACIS

Introduction

They call us the guardians of justice, the voice of the voiceless, the fierce defenders of the rule of law. But here is what they do not tell you: while we are busy protecting others, our finances are often unguarded.

Behind polished shoes and court-ready confidence, many lawyers quietly wrestle with financial instability, unplanned risks, and income volatility. Not because we lack intelligence—far from it—but because the system trained us to think like advocates, not investors. The danger lies in what we do not see coming.

This week, let us shine a light on the financial risks most lawyers ignore, the silent money traps we fall into, and how to construct a solid financial shield around your legal career.

Part 1: The Hidden Threats That No One Warns You About

Most lawyers assume the most significant risk is not having enough clients. But the real threats are subtler—slow leaks, not explosions. Here are the ones to watch for:

1. Single-Source Income Dependency

If all your money comes from one chamber, one firm, one partner, or one primary client, you are one bad month away from a cash crisis.

Reality check: What happens if the briefings stop or your retainer is not renewed?

2. Irregular Cash Flow

Legal income often comes in bursts. Big case? Big payday. Quiet month? Crickets.

But bills do not wait. School fees, rent, and life are all monthly guests—they do not care about your court calendar.

3. Delayed Payments and Unpaid Invoices

You win the case. Judgment delivered. Yet, the client suddenly vanishes. Or worse, they say “We will pay when we can.”

Without systems to enforce timely payments, you are in a cycle of uncertainty.

4. Lifestyle Creep

As you rise in the profession, your spending rises too, but not always your savings. A new car here, a luxury trip there. All it takes is one financial emergency to derail everything.

Part 2: The Money Mistakes Lawyers Keep Repeating

Even the sharpest minds can make emotional money moves. These are the top recurring errors lawyers make:

• Living Case-to-Case

Many lawyers do not pay themselves a salary. They treat case income as a current account balance. There is no structure, no plan.

• Delaying Investments

We are so focused on work, that we postpone wealth creation. Years pass before we buy real estate, set up mutual funds, or invest in pension plans.

• No Emergency Fund

One illness, one accident, one major family obligation and the entire financial setup collapses. Most lawyers do not have 3 to 6 months’ worth of living expenses saved.

• Ignoring Insurance

We fight legal battles daily but neglect the most basic protection—health, life, income protection, or indemnity insurance.

• Failing to Track Expenses

If you can not measure it, you can not manage it. Many lawyers do not have personal or business budgets. It’s all “mental math” until the numbers do not add up.

Part 3: How to Build a Financial Safety Net for Your Legal Career

If you are a lawyer looking to future-proof your finances, here is a simple framework:

1. Pay Yourself a Monthly Salary

Even if you are in solo practice, create a business account and separate your income from your lifestyle. Pay yourself a structured amount and leave the rest in your firm’s account for savings and growth.

2. Build an Emergency Fund

Start small, aim for 3 months’ worth of essential expenses. Gradually grow it to 6 months. Use a dedicated savings account or money market fund to keep it accessible but untouched.

3. Automate Your Savings & Investments

Every month, set up auto-debits into:

1. Mutual funds or fixed-income investments

2. A retirement savings plan (PENCOM-compliant or private)

3. Real estate cooperatives or land banking schemes

Let your money leave before you are tempted to spend it.

4. Diversify Your Income

Explore non-litigation revenue streams: online courses, real estate, legal consulting, content creation, or subscription-based legal services.

The wealthiest lawyers earn outside the courtroom.

5. Get the Right Insurance

At a minimum:

1. Health insurance for you and your dependents

2. Term life insurance (especially if you have children)

3. Professional indemnity (especially for corporate and property lawyers)

Insurance may seem like a cost—until you need it. Then it becomes priceless.

Final Thoughts: Don’t Just Defend Clients. Defend Your Future.

In court, we prepare thoroughly. We anticipate counterarguments. We never walk in unarmed.

Yet, many of us go into life financially exposed, relying on hope and hustle. But hope is not a strategy and hustle burns out. The truth is that lawyers do not go broke from lack of income; they go broke from poor planning. If you want to build wealth and security in this profession, you must be as strategic with your money as you are with your legal arguments.

So, ask yourself:

Am I building a career or a financial time bomb?

The best time to start building your safety net was yesterday.

The second-best time? Now.

#FinancePotentials.

Connect with me on Social Media:

X: CIAO Legal

LinkedIn: Chinelo Audrey Ofoegbunam

Instagram: CIAO Legal

Facebook: Chinelo Ofoegbunam